April 24, 2024

Selected disclosure for first 3 months of 2024

- €5.5 BILLION OF NEW ORDERS ACQUIRED YEAR-TO-DATE, REACHING APPROXIMATELY 50% OF 2024 TARGET

- GLOBAL MEGATRENDS BRING COMMERCIAL PIPELINE IN CORE MARKETS AT MORE THAN €70 BILLION, OF WHICH €13 BILLION OF TENDERS SUBMITTED, AWAITING OUTCOME

- 2024 GUIDANCE CONFIRMED: REVENUES SEEN EXCEEDING €11 BILLION, EBITDA ABOVE €900 MILLION, NET CASH AT MORE THAN €400 MILLION

****

MILAN, April 24, 2024 – The Board of Directors of Webuild (Euronext Milan: WBD) examined today the following data and information relating to the business evolution since the start of 2024.

***

Since the beginning of the year, Webuild has acquired €5.5 billion of new orders. Almost all of them comes from foreign markets such as Canada, the United States and Saudi Arabia. The significant order intake represents approximately 50% of the expected orders for 2024. In addition, the Group has a short-term commercial pipeline of more than €70 billion thanks to the major investment plans being launched in key markets such as Central and Northern Europe, Australia, the United States and the Middle East.

Significant progress has been made on projects both in Italy and abroad during the first months of the year. The first eight kilometres of Italy’s Milan-Genoa high-speed railway has opened between Rivalta Scrivia and Tortona; construction has begun on the water treatment plant for the vast onshore oil complex at ZULUF in Saudi Arabia; and tunnel excavations on the 106 Ionian Highway and Lot 2 of Line 16 of the Grand Paris Express have made important progress.

The training programme “Cantiere Lavoro Italia”, designed to attract new talent to the sector of large civil infrastructure and establish a professional standard, has started the first two courses for 45 site operators in Calabria, a region in southern Italy. Webuild plans to hire 10,000 people by 2026 for major projects across Italy.

During the first quarter of 2024, the shareholders' agreement between Webuild’s main shareholders, Salini S.p.A and CDP Equity S.p.A., was renewed ahead of time with a new expiry date of February 28, 2027. The signing of a new agreement testifies to the commitment of these two shareholders (including specific lock-up commitments) to ensure continuity in the governance, management and shareholder structure of the Company.

In addition, the Group obtained another international award for its commitment to Environmental, Social and Governance (ESG) principles. In fact, the CDP (formerly Carbon Disclosure Project), as part of its Climate Change 2023 Programme, has confirmed Webuild as a world leader in climate change action, allocating it a “A-” rating - above the European and sector averages.

****

2024 NEW ORDERS

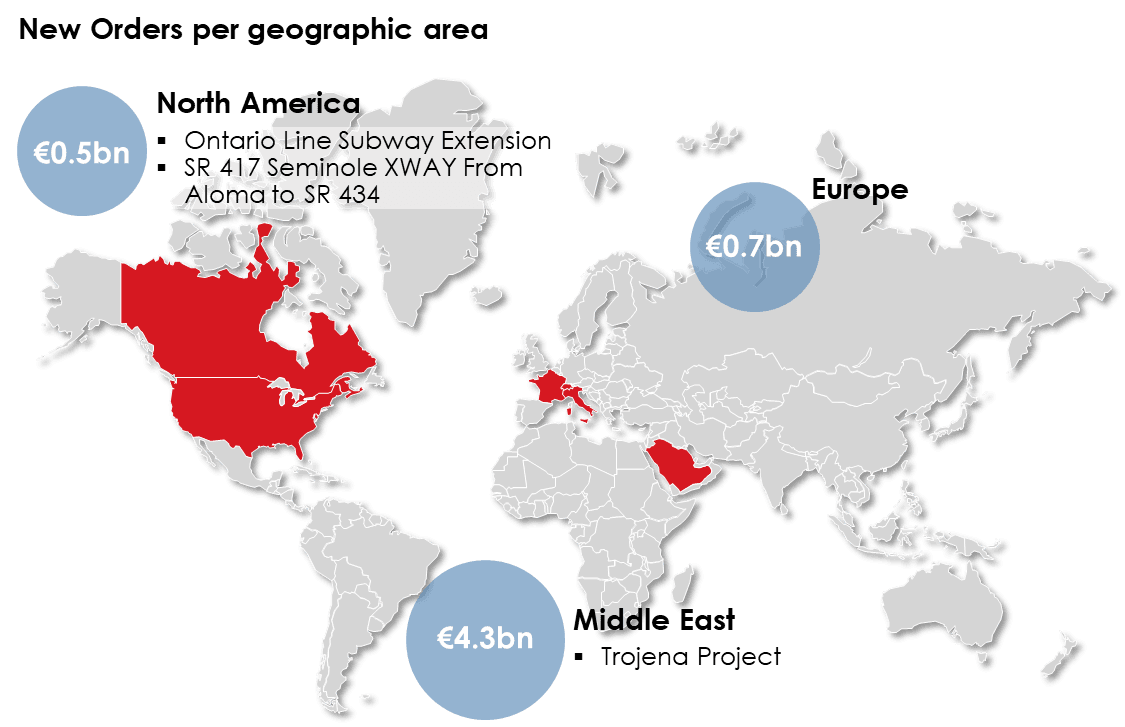

Total new orders acquired and being finalised since the beginning of the year amount to €5.5 billion, including €0.7 billion worth of projects for which Webuild is the preferred bidder. Below is the geographical distribution of the new orders and the list of main contracts acquired:

- Trojena Project: construction of three dams and associated innovative works to feed a freshwater lake at a ski resort in Trojena as part of the futuristic NEOM project in Saudi Arabia worth $4.7 billion. The project also includes “The Bow”, an architectural structure that will extend the surface of the lake beyond the front of the main dam. In addition to supporting the development and regeneration of the Trojena area, which will host the 2029 Asian Winter Games, the project is part of the Saudi Vision 2030 for the economic diversification of the country.

- Pape Tunnel and Underground Stations: development and construction of the “Pape Tunnel and Underground Stations (PTUS)” section of the new Ontario Line, a rapid underground service that will run through the Canadian city of Toronto. The work, with a total estimated value of between approximately €700 million and €1.3 billion (CAN$1-2 billion), will be executed as a “Progressive Design-Build”, an innovative contract model involving close collaboration between the client, contractor and designer, meaning lower execution risks in the start-up and construction phases of the project. The final value will be determined by the final design. The overall project involves the construction of three kilometres of tunnels and two underground stations. Webuild was awarded the project as a joint venture with a 50% share.

- Seminole Expressway/SR 417: design and build on an expansion from four to eight lanes of a six-mile (9.7 kilometres) section of the Seminole Expressway/SR 417 state road in Seminole County, in Florida. Commissioned to Webuild through its U.S. subsidiary Lane, the contract has a total value of $299 million.

****

COMMERCIAL PIPELINE

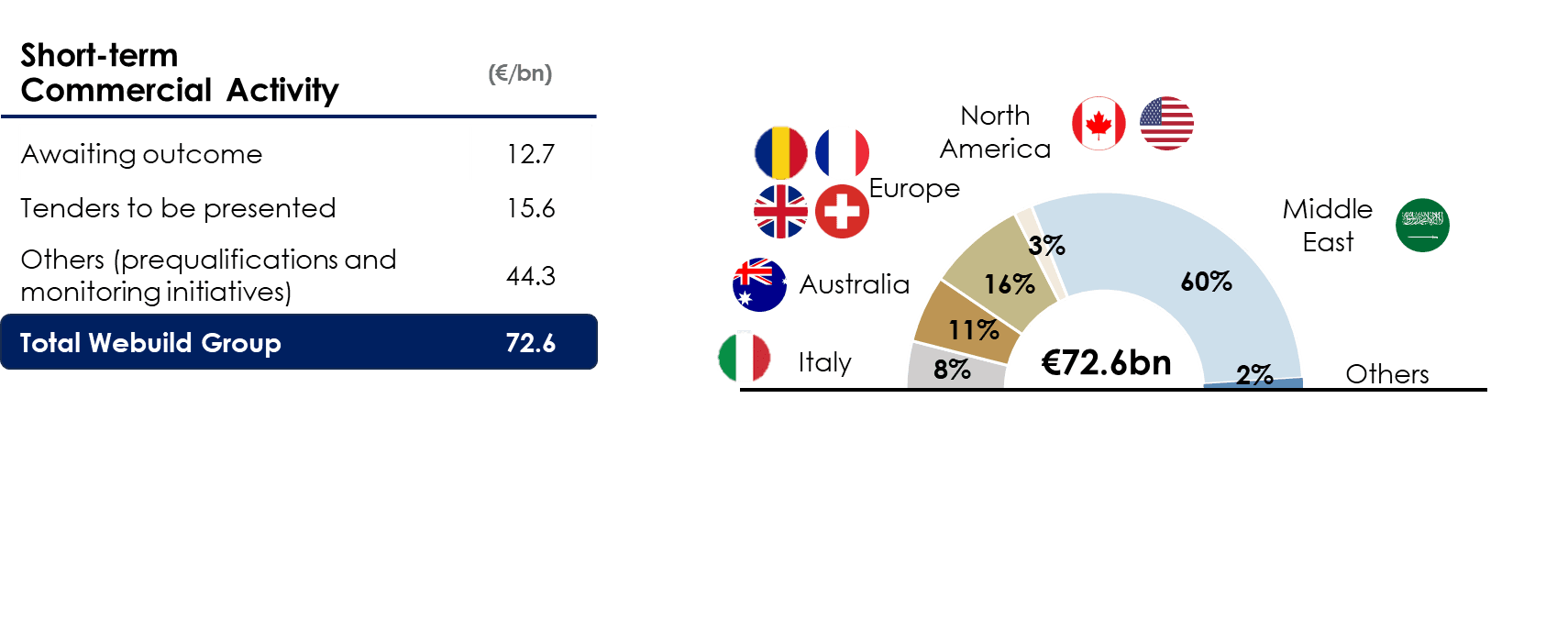

Webuild’s short-term commercial pipeline amounts to approximately €72.6 billion and includes tenders submitted and awaiting an outcome for approximately €12.7 billion.

As part of its strategy to position itself in low-risk, Webuild continues to monitor opportunities in Europe, Australia, North America and the Middle East. The investments plans in the Group's main markets of interest, such as the Next Generation EU Fund and REPowerEU in the European Union, the Powering Australia Plan in Australia, the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA) and the CHIPS and Science Act in the United States, and the Saudi Vision 2030 plan in Saudi Arabia, are all expected to continue to provide a strong boost to the infrastructure market in the coming years, especially in the civil infrastructure sector, including railways and roads, and industrial and energy infrastructure.

Below is a breakdown of the pipeline by category and geography:

****

OUTLOOK

The evolution of the commercial and business activities in the first quarter of the year, as well as the volume and quality of the order backlog, allow the Group to confirm the financial guidance for 2024: a book-to-bill greater than 1.0 times, and the continuation of the growth trend with revenues exceeding €11 billion and EBITDA greater than €900 million. Despite this growth, the Group will remain focused on cash generation, maintaining a solid net cash position, which is expected to exceed €400 million.

****

Disclaimer

This press release contains forward-looking statements. These statements are based on the Group's current expectations and projections regarding future events and, by their nature, are subject to an inherent component of risk and uncertainty. They are statements that relate to events and depend on circumstances which may or may not happen or occur in the future and, as such, undue reliance should not be placed on them. Actual results may differ even significantly from those announced due to a variety of factors, including: volatility and deterioration of capital and financial markets, changes in commodity prices, changes in macroeconomic conditions and growth economic and other changes in business conditions, of an atmospheric nature, due to floods, earthquakes or other natural disasters, changes in legislation and the institutional context (both in Italy and abroad), difficulties in production, including constraints in the use of plants and supplies and many other risks and uncertainties, the majority of which are beyond the control of the Group.